When planning for retirement, healthcare expenses should be a top consideration. Medicare Supplement plans, also known as Medigap, can provide additional coverage to your existing Medicare plan. Among the most popular options is Medicare Supplement Plan G, which offers comprehensive benefits at an affordable cost.

Understanding the financial aspect of Plan G is critical to ensure you can budget for healthcare expenses effectively. In this section, we’ll dive into the average cost of Medicare Supplement Plan G, factors that affect the pricing, and tips on managing the cost.

- Medicare Supplement Plan G offers comprehensive coverage at a reasonable price.

- The average cost of Plan G varies based on several factors, such as your location, age, and health status.

- Understanding the value provided by Plan G is equally crucial as understanding its cost.

- Obtaining accurate quotes and managing expenses can help you minimize healthcare costs.

- Staying informed about future trends can help you plan your healthcare budget effectively.

What is Medicare Supplement Plan G?

Before we delve into the cost of Plan G, it’s crucial to understand what it encompasses. Plan G is one of several Medicare Supplement plans designed to fill the gaps in Original Medicare coverage. It provides comprehensive coverage for medical expenses, including hospitalization, skilled nursing facility care, and outpatient medical services.

Plan G also covers the annual Medicare Part B deductible, which makes it a popular option among Medicare beneficiaries. With Plan G, you’ll only have to pay the deductible once a year, and after that, your Medicare Part B-covered services will be covered in full.

Compared to other Medicare Supplement plans, Plan G provides extensive coverage and is often described as a “middle-of-the-road” option. It’s a cost-effective alternative to Plan F, which has similar coverage but is no longer available to new enrollees.

If you’re considering Plan G, it’s essential to compare its costs with other Medicare Supplement plans and evaluate the overall value it provides.

Medicare Supplement Plan G Cost Comparison

When comparing Medicare Supplement plans, the cost is a crucial factor to consider. The monthly premiums for Plan G can vary depending on several factors, such as your location, age, and health status. However, in general, Plan G tends to have lower monthly premiums than some other high-coverage options, such as Plan F.

While Plan G may have a slightly higher monthly premium than some lower-coverage options, such as Plan N or Plan A, it provides more comprehensive coverage, making it a more cost-effective option in the long run.

When evaluating the cost of Plan G, it’s also important to factor in any out-of-pocket expenses, such as copayments or coinsurance. In some cases, other Medicare Supplement plans may have lower monthly premiums but higher out-of-pocket costs, making them more expensive overall.

Comparing the costs of Medicare Supplement plans can be overwhelming, but it’s essential to find the one that meets your unique health needs and budget. By evaluating the monthly premiums and out-of-pocket costs of various plans, you can make an informed decision and find the most cost-effective option for your healthcare coverage.

Factors Affecting Plan G Medicare Supplement Cost

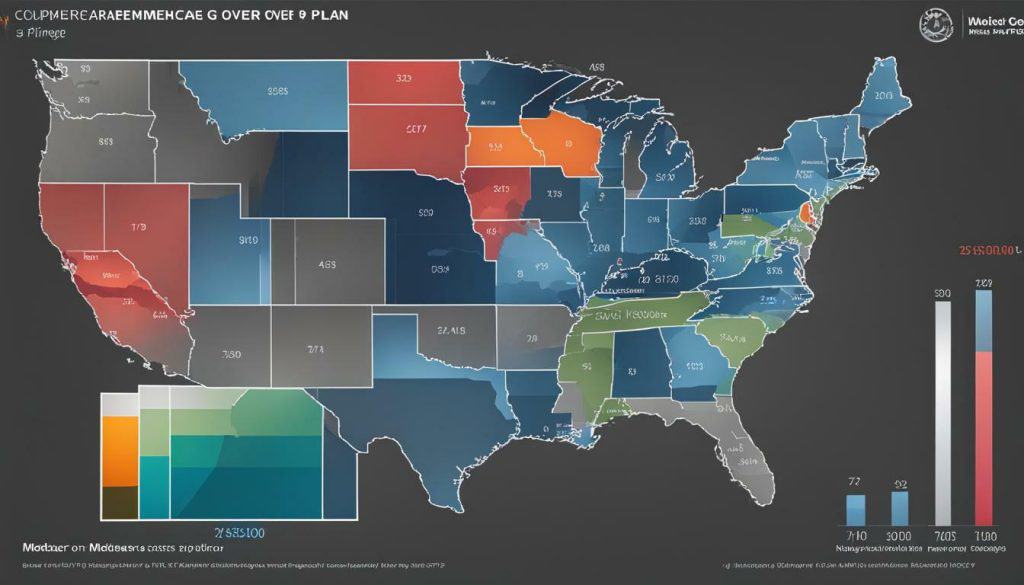

Several factors can impact the average cost for Plan G Medicare Supplement, making it essential to understand why the cost may be different for each individual. Age, gender, location, and tobacco use are some of the contributing elements that can affect the cost of your Plan G policy.

Your age is one of the primary factors that can impact the cost of your Medicare Supplement plan. Insurance providers often assume that older adults require more healthcare services than younger people, so premiums may increase as you age. Additionally, women may have higher premiums than men because they tend to live longer and use healthcare services more frequently.

Your location can also play a role in determining your Plan G Medicare Supplement costs. Insurance providers may charge higher premiums in areas with more expensive healthcare services or if there is a more significant demand for healthcare services in your area.

Finally, your tobacco use can impact your Medicare Supplement Plan G cost. Tobacco users may have higher premiums than non-tobacco users due to the increased likelihood of requiring healthcare services. Quitting smoking can help reduce your premiums and improve your overall health.

Remember to consult with your insurance provider to understand which factors may impact your Plan G Medicare Supplement cost.

Now, let’s explore the average cost of Medicare Supplement Plan G. According to recent estimates, the monthly premium for Plan G ranges from $120 to $300, depending on your location and insurance provider. It’s important to note that you may also encounter additional out-of-pocket expenses, such as deductibles and copayments.

| State | Average Monthly Premium |

|---|---|

| California | $210 |

| Florida | $170 |

| Illinois | $150 |

| New York | $250 |

The cost of Medicare Supplement Plan G can vary based on several factors, such as your age, gender, health status, and the insurance provider you choose. For example, older individuals may be charged higher premiums, while those with pre-existing conditions may face additional costs.

Factors Affecting Plan G Medicare Supplement Cost

Let’s take a closer look at some of the key factors that can affect the cost of Medicare Supplement Plan G:

- Age: As you get older, your premium may increase.

- Location: The cost can vary depending on where you live.

- Insurance Provider: Different providers may offer varying rates for Plan G.

- Health Status: If you have pre-existing conditions or require medical services, you may encounter additional costs.

- Enrollment Period: The timing of your enrollment can affect the cost.

Understanding these factors can help you get a more accurate estimate of what your Plan G premiums may cost. It’s always a good idea to shop around and compare prices from different insurance providers to ensure you’re getting the best deal.

When considering Medicare Supplement plans, it’s important to compare the costs of different options. Plan G is a popular choice due to its comprehensive coverage, but how does it stack up against other plans in terms of cost?

One plan that is often compared to Plan G is Plan F. Plan F offers similar coverage to Plan G, but it’s typically more expensive. In fact, Plan F is being phased out for new enrollees starting in 2020. This means that Plan G may become an even more popular option moving forward.

Another plan to consider is Plan N. While it doesn’t offer as much coverage as Plan G, it can be a more affordable option for some people. Plan N requires a small copay for doctor visits and emergency room visits, but it still covers a significant portion of medical expenses.

To get a better idea of how the costs compare, let’s take a look at a sample scenario. Assume that you live in California and are a non-smoking 65-year-old female. Here’s what you can expect to pay for each plan:

| Plan | Monthly Premium | Deductible | Coinsurance/Copay | Total Annual Cost |

|---|---|---|---|---|

| Plan G | $150 – $200 | $0 | $0 | $1,800 – $2,400 |

| Plan F | $170 – $220 | $0 | $0 | $2,040 – $2,640 |

| Plan N | $100 – $150 | $0 | Up to $20 for doctor visits | $1,200 – $1,800 |

As you can see, Plan G is generally more expensive than Plan N but can be a more affordable option than Plan F. However, it’s important to consider your unique healthcare needs and budget when making a decision.

Keep in mind that these costs are just estimates and can vary depending on your location, age, gender, and other factors. It’s essential to get personalized quotes to get an accurate idea of what you can expect to pay for each plan.

Now that you have a better understanding of how Plan G compares to other Medicare Supplement plans in terms of cost, you can make a more informed decision about which plan is right for you.

While cost is an important consideration when choosing a Medicare supplement plan, it’s equally crucial to understand the value provided by Plan G. This plan offers comprehensive coverage, including all the benefits of Medicare Parts A and B, along with additional benefits that can help reduce expenses and provide peace of mind.

Some of the benefits that make Plan G a valuable choice include:

- No deductibles: With Plan G, you won’t have to worry about meeting a deductible before your coverage kicks in. This can save you a lot of money in out-of-pocket expenses.

- Limited out-of-pocket expenses: Once you meet your Medicare Part B deductible, Plan G covers 100% of your Part B coinsurance and copayment amounts, which can add up quickly. Additionally, Plan G also covers excess charges from doctors who don’t accept Medicare’s approved amount, which can save you even more.

- Foreign travel emergency coverage: If you travel outside the United States and need medical care, Plan G provides coverage for emergency services. This can be invaluable if you travel frequently or for extended periods.

While the cost of Plan G may be slightly higher than other Medicare supplement plans, the value it provides can offset this expense and lead to long-term savings. With comprehensive coverage and limited out-of-pocket expenses, Plan G can provide peace of mind and financial security.

How to Obtain Accurate Quotes for Plan G

Obtaining accurate quotes for Medicare Supplement Plan G is an essential step in understanding the costs associated with this plan. With so many insurance providers offering Plan G coverage, it can be challenging to determine the most cost-effective option for your needs.

The first step is to research and compare quotes from multiple insurance providers. Visit their websites or call their customer service departments to request information on their Plan G coverage and pricing. Keep in mind that the pricing may vary based on your location, age, and other factors.

To ensure you receive accurate quotes, provide accurate information about yourself and your medical history. Insurance providers may ask about your age, gender, location, and pre-existing conditions, among other factors, to determine your risk and pricing. By providing truthful and thorough information, you can obtain the most accurate quotes and avoid any surprises down the road.

Once you have obtained several quotes, make sure to compare the pricing and coverage offered by each provider. Look for any additional benefits, such as fitness programs or prescription drug discounts, that may help offset the cost of Plan G.

In addition to comparing prices, consider the reputation and financial stability of the insurance provider. Research their customer reviews, financial ratings, and any complaints filed against them. Choosing a reputable and financially stable provider offers peace of mind and ensures you receive the coverage you need.

Overall, obtaining accurate quotes for Plan G involves thorough research and comparison. By taking the time to gather information and compare prices, you can find the most cost-effective option for your healthcare needs.

While Medicare Supplement Plan G can provide comprehensive coverage for your healthcare needs, it’s important to manage the associated costs effectively. Here are some tips to help you keep your expenses in check:

- Shop around for the best price: Don’t settle for the first Plan G policy you come across. Obtain quotes from different insurance providers and compare prices to find the best deal.

- Consider your healthcare needs: Analyze your current healthcare expenses and anticipate any future needs. This will help you choose a Plan G policy that aligns with your budget and requirements.

- Choose a high-deductible plan: Opting for a high-deductible Plan G policy can lower your monthly premiums. However, make sure you can comfortably afford the deductible before selecting this option.

- Stay within the network: If your Plan G policy includes a provider network, make sure to stay within it to avoid out-of-network expenses.

- Take advantage of wellness benefits: Many Plan G policies offer wellness benefits like gym memberships or health coaching programs. Take advantage of these benefits to maintain good health and potentially reduce healthcare expenses in the long run.

By following these tips, you can effectively manage the cost of your Medicare Supplement Plan G policy and ensure that it remains an affordable healthcare solution for you.

As you consider Medicare Supplement Plan G, it’s essential to look toward the future and consider potential trends that may impact the average cost of this coverage. One factor to keep in mind is the aging population in the United States, which is expected to increase demand for healthcare services.

Another consideration is the ongoing changes and updates to Medicare policies and regulations. These changes can have a significant impact on the cost of Medicare Supplement plans, including Plan G. Staying informed about upcoming changes and how they may affect your coverage can help you plan your healthcare expenses effectively.

Additionally, advances in medical technology and treatment options may increase the cost of healthcare services over time. While this is difficult to predict, it’s vital to consider and plan accordingly as you evaluate your options for Medicare Supplement coverage.

In summary, predicting the future cost of Medicare Supplement Plan G is challenging, but it’s essential to consider potential trends and prepare accordingly. Staying informed and planning ahead can help you make the most of your healthcare coverage and minimize expenses in the golden years of your life.

In conclusion, understanding the average cost of Medicare Supplement Plan G is crucial for making informed decisions about your healthcare. By considering the factors that influence the cost and comparing it to other options, you can ensure your golden years are worry-free.

Remember to obtain accurate quotes to compare prices and find the best deals. Additionally, manage your expenses wisely by exploring available cost-saving strategies.

Staying informed about future trends and predictions for Plan G will help you plan your healthcare budget effectively. With its comprehensive coverage benefits, Plan G can provide you with peace of mind when it comes to your healthcare needs.

As you evaluate your Medicare Supplement plan options, keep in mind the plan G Medicare Supplement insurance cost and the value it provides. With a clear understanding of the financial aspect of this plan, you can make the best decision for your healthcare needs and financial well-being.

FAQ

Q: What is the average cost of Medicare Supplement Plan G?

A: The average cost of Medicare Supplement Plan G can vary depending on various factors such as your location, age, gender, and health status. It’s best to obtain accurate quotes from insurance providers to get an exact cost estimate.

Q: How does Medicare Supplement Plan G compare to other plans in terms of cost?

A: Medicare Supplement Plan G is known for offering comprehensive coverage while maintaining a more affordable cost compared to some other plans, such as Plan F. However, the cost can still vary, so it’s important to compare prices and coverage options.

Q: What factors can affect the cost of Medicare Supplement Plan G?

A: Several factors can influence the cost of Medicare Supplement Plan G. These include your age, gender, location, smoking status, and health conditions. Additionally, different insurance providers may offer varying premiums, so it’s wise to shop around for the best price.

Q: Are there any additional out-of-pocket expenses with Medicare Supplement Plan G?

A: Medicare Supplement Plan G typically covers most of your Medicare Part A and Part B out-of-pocket expenses. However, you may still have to pay the Part B deductible and any excess charges for services not fully covered by Medicare.

Q: How do I obtain accurate quotes for Medicare Supplement Plan G?

A: To get accurate quotes for Medicare Supplement Plan G, you can contact insurance providers directly or use online tools that specialize in comparing Medicare supplement plans. By providing the necessary information, you can receive personalized quotes tailored to your needs.

Q: What are some tips for managing the cost of Medicare Supplement Plan G?

A: To manage the cost of Medicare Supplement Plan G, you can consider factors such as your healthcare needs, budget, and available discounts. It’s also helpful to review your plan annually to ensure it still meets your needs and explore potential cost-saving strategies, like using preferred providers.

Q: What are the future trends and predictions for the cost of Medicare Supplement Plan G?

A: It’s challenging to predict the exact future cost of Medicare Supplement Plan G, as it can be influenced by various factors, such as changes in healthcare policies, medical advancements, and economic conditions. Staying informed about industry trends and regularly reviewing your plan can help you make proactive decisions regarding your healthcare budget.